1/29/07: The .QIF import feature added to Cha-Ching 0.5 is buggy and unreliable. I was never able to import a file, even after trying different “line-ending” formats as suggested in the Cha-Ching forums. The developer has noted the problem and pledged to fix it by the next release… I’ll try again then.

1/23/07: Added Buddi to list of candidates in Addendum.

I’ve been using Quicken on my Mac for over 10 years now. Quicken came free with the very first Mac I bought back in 1996, and having nothing else to compare it against, it seemed like a pretty good thing. Sure, it was buggy, and as time went by I realized it was just a pale shadow of the version Intuit was providing to its Windows customers. But it definitely was saving my wife and I time at the end of the month in paying bills and reconciling the checkbook.

By now, I’ve grown accustomed to Quicken’s face, but unlike Henry Higgins’ statement in My Fair Lady, that’s not a compliment. I hate Quicken’s face, in fact, and I detest the continued second-citizen status Quicken consigns me to in the world of personal finance. That’s not totally Intuit’s fault, but they haven’t done a good job of improving Mac users’ lot much over time. I guess I should feel lucky that I can connect online and automatically download transactions from my bank. Too bad I can’t do the same with the mutual fund company where I have my IRA money.

The worst thing about Quicken’s face is the total absence of control over all the windows that get spawned. You think the Finder is bad? Then you haven’t spent much time in Quicken! Fortunately, I use WindowShade to keep my account windows from taking over, but do you know what? Quicken can’t remember from session to session where I’ve left my windows, or in what state I left them. This means I have to spend a minute or so each time I open the damn software to rearrange all those windows. What fun! :-{

The next worst thing is the incomprehensible set of menus and toolbar items. Quicken’s interface appears to have grown like the suburbs of most U.S. cities in the last few decades—that is, totally without order, logic, or aesthetics of any sort. This is probably why I never venture far when I enter QuickenLand… Just do my checkbook, pay a few bills, update a few stock prices, and get the hell out of there.

Naturally, Quicken has no concept of the Mac OS X Cocoa framework, so all the neat little user interface utilities I use in my other Mac apps don’t work here… or they work with a jerk. Application services? Ha! Automator actions or Spotlight support? Ha Ha! Intuit has made no attempt whatsoever to keep Quicken up to date with the latest and greatest Mac OS X technologies, and if I’m a typical customer, I can understand why.

I’m so locked into Quicken that it’s almost painful contemplating my escape. Not only do I have the last 10 years of financial data locked in there, but I also spent a lot of time early on entering all my data back to the early 1980’s. Some of my investment account data go back even further than that. I know that some Mac customers have gotten free, but I also know they probably had to spend a lot of time digging themselves out. And once they were out, did they feel like Neo waking up outside the Matrix? Lord, I hope not!

So I’ve been keeping a close eye on the various personal finance packages that are available for the Mac. In the last 2 years, there have finally been a few apps that looked interesting enough to do more than just open them, take a quick look around, and leave. I’ve now tried four of them and have at least four more to go. As I finish the trials, I’ll keep this article updated on my prospects for a Quicken escape.

![]() The first app I tried a couple of months ago was a definite reject… You can read my mini-review of Checkbook elsewhere on this blog. The next three, which I’m including in this article today, are more interesting. Thinking of picking up my belongings in Quicken and trudging over to these others doesn’t totally inspire me, but I do think it would be possible—and that’s a step in the right direction as far as I’m concerned. As I noted in my Checkbook writeup, there are several things that have to come together to create a truly painless transition from Quicken for me:

The first app I tried a couple of months ago was a definite reject… You can read my mini-review of Checkbook elsewhere on this blog. The next three, which I’m including in this article today, are more interesting. Thinking of picking up my belongings in Quicken and trudging over to these others doesn’t totally inspire me, but I do think it would be possible—and that’s a step in the right direction as far as I’m concerned. As I noted in my Checkbook writeup, there are several things that have to come together to create a truly painless transition from Quicken for me:

- Import my Quicken data, including all my accounts, categories, and other metadata. Preferably, this would involve merely importing one big .QIF file from Quicken, but may require many round-trips to export and import individual accounts.

- Handle online transactions with my bank.

- Support my historical and future investment transactions, and

- Provide a scalable financial repository with a reasonably fast interface to get things done.

Those are just the bare-bones requirements, and I’ll be happy if I can find an app that will handle just those. However, I’m really looking forward to working in an interface that acts like a Mac and isn’t afraid to show off a little.

As for the three apps I’m inaugurating this list with, I’ll have to either wait until one of them grows up enough to handle all of these requirements, or give up on one or more of them in anticipation that my monthly bill-paying exercise might be a bit more fun.

If I had to choose one of these today, it would probably be Liquid Ledger, which has the best combination of looks, usability, functionality, and Quicken compatibility. Its biggest drawback is an inability to handle investment transactions, but the company says that will be included in the next revision (due early 2007). Cha-Ching has a ways to go before it catches up to where Liquid Ledger and iBank already are. Its biggest shortcoming—it can’t import .QIF files—is due to be addressed in the next dot-release of Cha-Ching, so we’ll see how that goes. It definitely has the most innovative interface design. iBank has most of the requirements covered, though it’s quite weak at importing Quicken data, has a frustrating set of restrictions on its demo use, and produces more frustrating application behavior than I’d like—incredibly slow performance and/or application freeze/crashing. All the gory details on these three are included below, along with screenshots.

As I finish others in this category, I’ll add them to this list, in alphabetical order. Products that I especially like and intend to either adopt or keep watching for awhile are designated with checkmarks (![]() ).

).

For the future, I have a four or five other apps in this category that I plan to try over the next weeks (months?), and if new ones show up before I actually make my escape from Quicken, I’ll add them, too. These are listed in the Addendum

![]()

Cha-Ching

Cha-Ching is still so early in its development that it’s hard to say for sure whether I’ll like it when it grows up. However, the developers clearly are trying to imbue a sense of fun into personal finance, and they’re trying to keep things simple. Too simple at the moment, unless you’re just starting your first checking account at a time when your finances are straightforward and, well, simple. Even then, if you do any electronic bill-paying, you might find it a pain that you have to enter all your transactions—incoming as well as outgoing payments—by hand. Still, for certain kinds of transactions—for example, a ledger accounting for all your personal belongings, or for a small collection of baseball cards or comic books—Cha-Ching offers some unique features that others in this category don’t, such as the ability to snap a photo of an object with iSight and attach it to your Cha-Ching entry. Hardly a core requirement, but it’s imaginative and indicative of a development team willing to think way outside the box. With its beautiful interface and tantalizingly cool features, Cha-Ching is an app I’ll definitely keep an eye on, but it can’t help free me from Quicken at the moment.

Cha-Ching is still so early in its development that it’s hard to say for sure whether I’ll like it when it grows up. However, the developers clearly are trying to imbue a sense of fun into personal finance, and they’re trying to keep things simple. Too simple at the moment, unless you’re just starting your first checking account at a time when your finances are straightforward and, well, simple. Even then, if you do any electronic bill-paying, you might find it a pain that you have to enter all your transactions—incoming as well as outgoing payments—by hand. Still, for certain kinds of transactions—for example, a ledger accounting for all your personal belongings, or for a small collection of baseball cards or comic books—Cha-Ching offers some unique features that others in this category don’t, such as the ability to snap a photo of an object with iSight and attach it to your Cha-Ching entry. Hardly a core requirement, but it’s imaginative and indicative of a development team willing to think way outside the box. With its beautiful interface and tantalizingly cool features, Cha-Ching is an app I’ll definitely keep an eye on, but it can’t help free me from Quicken at the moment.

| Cha-Ching (Version 0.5, $25/$15) |

|

|---|---|

| Pros | Cons |

|

|

![]()

iBank

iBank was the first of these three that I tried, and I was immediately impressed with its refreshing interface. After Quicken, iBank’s rethinking of how to organize the functions of a personal finance app into a single window was a revelation. I found the software to be immediately usable, and after only a short while I was pretty comfortable navigating and working in iBank. Of all the three initially reviewed, iBank is the only one that theoretically has all the bases covered except the one (ability to download banking transactions without leaving its iterface). It can import .QIF files from Quicken, handle investment transactions, and offers some great conveniences I hadn’t even considered when contemplating a Quicken replacement. For example, with its single window iBank can provide a handy snapshot of your entire financial situation through its different panes, including the nice automatic pie chart view.

iBank was the first of these three that I tried, and I was immediately impressed with its refreshing interface. After Quicken, iBank’s rethinking of how to organize the functions of a personal finance app into a single window was a revelation. I found the software to be immediately usable, and after only a short while I was pretty comfortable navigating and working in iBank. Of all the three initially reviewed, iBank is the only one that theoretically has all the bases covered except the one (ability to download banking transactions without leaving its iterface). It can import .QIF files from Quicken, handle investment transactions, and offers some great conveniences I hadn’t even considered when contemplating a Quicken replacement. For example, with its single window iBank can provide a handy snapshot of your entire financial situation through its different panes, including the nice automatic pie chart view.

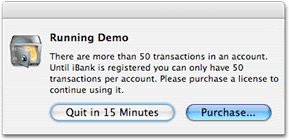

That said, iBank falls short in a couple big respects that keeps me from jumping the Quicken ship right away. First, its handling of the demo trial is not only irritating, but it hobbles the entire demo process. It’s really impossible  to determine how well iBank can handle my entire data set without letting me import and work with it. Instead, iBank restricts transactions in any given account to 50… and then it announces it’s going to quit in 15 minutes. (See my notes for more on this.) Second, iBank was exceedingly slow at importing .QIF files, and tended to hang on larger ones. I had to force-quit a couple of times during the test. At a minimum, these impressions made me anxious to continue trying other solutions from my list. Yet iBank had enough virtues that if nothing better materializes, I resolved to ask the company to let me try out a less restrictive demo of the software.

to determine how well iBank can handle my entire data set without letting me import and work with it. Instead, iBank restricts transactions in any given account to 50… and then it announces it’s going to quit in 15 minutes. (See my notes for more on this.) Second, iBank was exceedingly slow at importing .QIF files, and tended to hang on larger ones. I had to force-quit a couple of times during the test. At a minimum, these impressions made me anxious to continue trying other solutions from my list. Yet iBank had enough virtues that if nothing better materializes, I resolved to ask the company to let me try out a less restrictive demo of the software.

| iBank (Version 2.1.8, $40) |

|

|---|---|

| Pros | Cons |

|

|

![]()

LiquidLedger

I was really surprised by how much I liked LiquidLedger. In fact, until I discovered that it doesn’t yet handle investment accounts or transactions, I thought I had discovered my Quicken replacement and was ready to get out the checkbook. Liquid Ledger has the most useful interface I’ve yet encountered: Even though it doesn’t adhere to the single-window model of iBank and Cha-Ching, it’s a far cry from the one-window-for-each-account-and-everything-else-if-possible philosophy of Quicken, and the windows it does spawn make sense and add value to the experience. Its speed and accuracy at importing my entire set of Quicken data (minus the investment accounts and transactions) was astonishing, and this powerful feat alone made me realize I would eventually find a way out. Like Cha-Ching, LiquidLedger’s developers are thinking fresh about what users want in a personal finance application, and they’ve offered several unique options that go way beyond Quicken and make previously unthinkable tasks—unlike Cha-Ching, tasks whose value is immediately obvious—second nature. (I describe a couple of these in my notes.)

I was really surprised by how much I liked LiquidLedger. In fact, until I discovered that it doesn’t yet handle investment accounts or transactions, I thought I had discovered my Quicken replacement and was ready to get out the checkbook. Liquid Ledger has the most useful interface I’ve yet encountered: Even though it doesn’t adhere to the single-window model of iBank and Cha-Ching, it’s a far cry from the one-window-for-each-account-and-everything-else-if-possible philosophy of Quicken, and the windows it does spawn make sense and add value to the experience. Its speed and accuracy at importing my entire set of Quicken data (minus the investment accounts and transactions) was astonishing, and this powerful feat alone made me realize I would eventually find a way out. Like Cha-Ching, LiquidLedger’s developers are thinking fresh about what users want in a personal finance application, and they’ve offered several unique options that go way beyond Quicken and make previously unthinkable tasks—unlike Cha-Ching, tasks whose value is immediately obvious—second nature. (I describe a couple of these in my notes.)

Unfortunately, there’s that little problem of my IRA account, stocks, mutual funds, and other investments. LiquidLedger picked up their names and categories, but that was all. I do hope the developers follow through on their plan to make that functionality a top priority for the next release, because otherwise I’d be hard-pressed to justify spending $75 for this software, which is already more than Quicken (or any of the other options I’m looking at) costs. Once I realized this functionality was missing, I decided to postpone further trials until later. That decision was helped along by the discovery that LiquidLedger’s way of keeping you from stealing its software is to make it impossible for you to save any accounts you create with the demo version. Thus, I had to throw away all I’d done when I closed LiquidLedger after my first run-through with it.

| LiquidLedger (Version 1.5.4, $75) |

|

|---|---|

| Pros | Cons |

|

|

Addendum: More Personal Finance Apps To Come

Here are the applications I’ve currently got on my review list as possible Quicken replacements:

- iCash

- iFinance

- Money (from Jumsoft, not Microsoft)

- Moneydance (I’d tried this a couple of years ago, but it seems to have evolved quite a bit since then)

- Buddi

As I look at these and others that may come along, I’ll update this article with my notes.